Understanding how to use Target Circle Earnings (TCE) is crucial for businesses seeking to optimize their revenue and profitability. This comprehensive guide will delve into the concept of TCE, explore various methods for calculating it, and highlight its advantages and disadvantages.

By delving into real-world examples and case studies, we will uncover the best practices for using TCE effectively and shed light on its limitations and future trends.

Understanding Target Circle Earnings

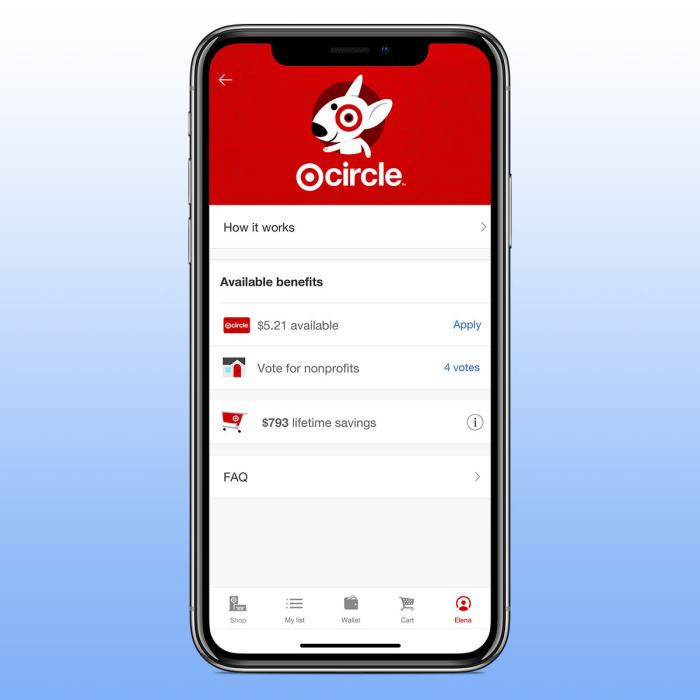

Target Circle Earnings (TCE) is a loyalty program offered by Target, a major retail chain in the United States. TCE allows customers to earn points on their purchases, which can be redeemed for discounts, gift cards, and other rewards.

TCE points are earned based on the amount of money spent at Target. For every $1 spent, customers earn 1 point. Points can also be earned by completing certain actions, such as signing up for Target’s email list or using the Target app.

TCE points can be redeemed for a variety of rewards, including:

- Discounts on future purchases

- Gift cards

- Free shipping

- Exclusive access to sales and promotions

TCE is a valuable loyalty program that can help customers save money on their Target purchases. By understanding how TCE works, customers can maximize their earnings and get the most out of their Target shopping experience.

Methods for Using TCE

Target Circle Earnings (TCE) can be calculated using various methods. The choice of method depends on the specific requirements and data availability. Here are the most commonly used methods:

Gross Earnings Method

This method calculates TCE as the total amount of gross earnings received by an individual during a specific period, typically a month or a year. It includes all forms of income, such as wages, salaries, bonuses, commissions, and tips. The formula for calculating TCE using the gross earnings method is:

TCE = Gross Earnings

Net Earnings Method

This method calculates TCE as the total amount of net earnings received by an individual after deducting taxes and other deductions from gross earnings. Net earnings represent the actual amount of money that an individual receives in their paycheck or bank account.

The formula for calculating TCE using the net earnings method is:

TCE = Gross Earnings

- Taxes

- Other Deductions

Adjusted Gross Income (AGI) Method

This method calculates TCE as the individual’s AGI reported on their tax return. AGI is calculated by subtracting certain deductions, such as standard deductions or itemized deductions, from gross income. The formula for calculating TCE using the AGI method is:

TCE = AGI

Advantages and Disadvantages of TCE

Target Circle Earnings (TCE) offers both advantages and disadvantages for investors.

Advantages of TCE

TCE provides several benefits for investors, including:

-*Enhanced Return Potential

TCE allows investors to potentially earn higher returns compared to traditional investments like bonds or savings accounts.

-*Diversification

TCE offers diversification benefits by investing in a wide range of underlying assets, reducing the overall risk of the portfolio.

-*Tax Advantages

TCE can provide tax advantages in certain cases, such as when held in a retirement account.

-*Convenience

TCE provides a convenient way to invest in a diversified portfolio without the need for extensive research or active management.

Disadvantages of TCE

While TCE offers advantages, it also has some potential disadvantages:

-*Market Volatility

TCE investments are subject to market fluctuations, which can lead to potential losses.

-*Management Fees

TCE funds typically charge management fees, which can reduce the overall return.

-*Complexity

TCE can be complex for some investors to understand, especially those new to investing.

-*Limited Control

TCE investors have limited control over the investment decisions made by the fund manager.

Applications of TCE

TCE has wide-ranging applications across various industries, including:

Retail, How to use target circle earnings

In retail, TCE is used to determine optimal pricing strategies and manage inventory levels. By analyzing historical sales data and customer demographics, retailers can identify the target circle earnings that maximize revenue and profitability.

Manufacturing

Manufacturers use TCE to optimize production processes and reduce costs. By analyzing machine performance and production data, manufacturers can identify areas for improvement and make informed decisions about investments in new equipment or process changes.

Healthcare

In healthcare, TCE is used to allocate resources and improve patient outcomes. By analyzing patient data and treatment costs, healthcare providers can identify the most effective and cost-efficient treatment options for each patient.

Case Study

A retail company used TCE to analyze its sales data and determine the optimal pricing strategy for a new product. By analyzing historical sales data and customer demographics, the company identified a target circle earnings of $10 per unit. The company then set the price of the product at $15 per unit, which resulted in a significant increase in sales and profitability.

Best Practices for Using TCE

To maximize the effectiveness of TCE, it’s crucial to follow certain best practices. These principles ensure that TCE is used accurately and consistently, leading to reliable and meaningful results.

By adhering to these best practices, organizations can harness the full potential of TCE to optimize their financial planning and decision-making processes.

Key Principles of Using TCE

- Establish clear objectives:Define the specific goals and purposes for using TCE. This clarity ensures that the analysis is focused and aligned with the organization’s strategic objectives.

- Use reliable data:Ensure that the financial data used in TCE is accurate, complete, and consistent. This foundation is essential for producing trustworthy and meaningful results.

- Consider multiple scenarios:Conduct TCE analysis under various assumptions and scenarios to assess the impact of different factors on earnings. This comprehensive approach provides a more robust understanding of potential outcomes.

- Incorporate qualitative factors:While TCE primarily relies on quantitative data, it’s important to consider qualitative factors that may influence earnings, such as market trends, regulatory changes, and operational efficiency.

- Seek expert advice:If necessary, consult with financial experts or industry analysts to gain insights and ensure the accuracy and validity of TCE analysis.

Limitations of TCE

While TCE offers valuable insights into a company’s earnings, it has certain limitations that must be considered when using it.

One limitation is that TCE does not account for non-operating income, which can significantly impact a company’s overall financial performance. Non-operating income includes items such as interest income, dividend income, and gains from the sale of assets. These items can boost a company’s earnings but are not directly related to its core operations.

Situations Where TCE May Not Be Appropriate

TCE may not be an appropriate measure of earnings in certain situations, such as:

- When a company has significant non-operating income or expenses.

- When a company has recently acquired or disposed of a major business segment.

- When a company is undergoing a major restructuring or change in its business model.

In these situations, TCE may not provide an accurate representation of the company’s core earnings and may lead to misleading conclusions about its financial performance.

Future Trends in TCE: How To Use Target Circle Earnings

Target Circle Earnings (TCE) is expected to continue gaining traction in the coming years as businesses seek to optimize their earnings and enhance financial performance. Several trends are shaping the future of TCE:

- Increased Adoption:TCE is becoming more widely adopted as businesses recognize its benefits in managing financial risks and improving profitability.

- Technological Advancements:Advancements in technology, such as artificial intelligence (AI) and machine learning (ML), are enhancing the accuracy and efficiency of TCE calculations.

- Integration with Other Systems:TCE is increasingly being integrated with other financial systems, such as enterprise resource planning (ERP) and customer relationship management (CRM) systems, to provide a comprehensive view of financial performance.

- Globalization:The increasing globalization of businesses is driving the need for TCE as a tool to manage currency fluctuations and other global financial risks.